This is a very specific, technical post. However, I can’t be the only person that has struggled with calculating New York sales tax on clothing with Woocommerce Shipping & Tax. So, I’m going to post the solution that worked for me.

If you’re not working on a Woocommerce store selling clothing in New York and having trouble accurately calculating sales tax, you’ll probably want to move on. If you are, keep reading…

Disclaimer: I am not a tax professional, you should consult one if you have any tax related questions.

The Problem

This was the situation:

- Woocommerce

- Woocommerce Shipping & Tax plugin (f.k.a Woocommerce Services)

- Automated taxes enabled

- An ecommerce store based in New York City selling apparel

Initially, this setup was charging sales tax on all of the apparel items that should have been tax exempt. Unfortunately, the Woocommerce shipping & tax documentation didn’t provide any information on how to charge product-specific rates either.

The “easy” solution of setting the apparel items to non-taxable wasn’t correct since several counties in New York require sales tax on apparel. I (very) briefly considered forgoing automatic sales tax calculation and entering the rates directly in Woocommerce–a lot of information to enter and manage.

Luckily, I found a way to have the tax on clothing to calculate accurately and automatically.

The Solution

A closed issue on the Shipping & Tax plugin’s Github repository offered a solution: If a valid product tax code is provided, it will use it to calculate the tax. Providing the tax code is pretty simple, but undocumented as far as I can tell.

How to set up a clothing tax rate

- Follow the instructions for setting up Woocommerce Tax & Shipping

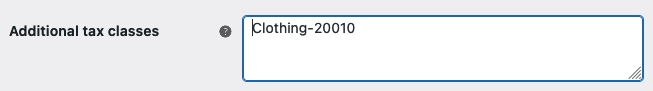

- In Woocommerce > Settings > Tax add an additional tax rate class: “Clothing–20010”

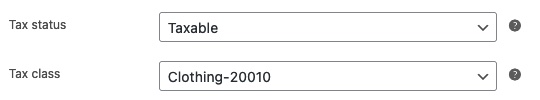

- Change the tax rate on apparel items to the Clothing–20010 tax class

- Test in the shopping cart with different items and addresses. Some suggestions:

- Item < $110 shipping to NYC, no tax

- Item > $110 shipping to NYC, tax

- Items shipping to counties that tax (e.g. Albany) get taxed at their rate regardless of price (see rates on NYS Tax Site)

So far, this is working well for me, and it’s much better than having to maintain the rates myself.